Business

Arrowtown Residents Prepare for Height Limit Hearings

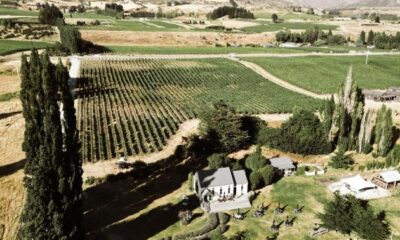

Residents of Arrowtown are bracing for a series of hearings that could significantly alter the character of their historic township. Beginning next week, three rounds of submission hearings will take place at Arrowtown’s Athenaeum Hall, focusing on the proposed urban intensification variation introduced by the Queenstown Lakes District Council. This variation aims to amend the district plan by increasing building heights and densities in residential and business zones near commercial centres in Queenstown, Arrowtown, Frankton, and Wānaka.

The initiative arises from a government mandate requiring urban centres to prepare for denser, more affordable housing. However, many Arrowtown residents are expressing concerns about the prospect of allowing housing up to 12 metres high—11 metres plus a pitched roof—potentially transforming the landscape of the township.

Under the proposed variation, a height limit of 12 metres could be applied to 266 medium-density-zoned properties in areas like the old Adamson subdivision, where the current limit stands at 7 metres, or two-storey buildings. The implications of such changes have left residents alarmed and questioning the preservation of Arrowtown’s unique character.

In a report submitted to the panel, Amy Bowbyes, the council’s principal planner for resource management policy, has suggested amendments to the proposed rules. She recommends allowing a permitted building height of 9 metres—8 metres plus a pitched roof—in Arrowtown’s medium-density zone. For the lower density suburban residential zone, Bowbyes proposes a height limit of 6.5 metres, with a restricted discretionary building height band ranging from 6.5 metres to 8 metres.

Bowbyes believes these amendments would “better recognise Arrowtown’s character,” addressing the community’s concerns while still fulfilling the government’s requirements for increased housing density.

The hearings for Queenstown submissions will take place from August 4 to 8 at the Queenstown Memorial Centre, followed by Wānaka submissions, which will be heard from August 25 to 27 at Edgewater Resort. As the discussions unfold, the future of Arrowtown’s architectural landscape hangs in the balance, with residents keenly watching how their voices will influence the council’s decisions.

Business

QNB Enhances Banking Access for Elderly and Individuals with Disabilities

QNB Group is taking significant steps to improve banking services for the elderly and individuals with special needs. The initiative aims to enhance financial inclusion and ensure that these groups can conduct their financial transactions with ease and security. The bank is developing specialized facilities and products designed to meet their unique needs.

The group is committed to providing comprehensive banking services in Qatar and across its international network, which spans over 28 countries across three continents. This commitment is part of a broader strategy to empower these individuals as valuable contributors to society.

Commitment to Accessibility and Inclusion

Yousef Mahmoud Al-Neama, Group Chief Business Officer, emphasized the bank’s dedication to facilitating convenient access to its services for the elderly and those with disabilities. “We are constantly developing the services we provide and training our employees on how to interact and communicate effectively with this segment of customers,” he stated. Al-Neama highlighted the importance of adhering to the highest quality standards in customer service.

To improve the banking experience, QNB has implemented various facilities across its branches and electronic channels. This includes the launch of a special pensioner loan at the beginning of this year, offering a 0% interest rate and a loan value of up to QR300,000 for Qatari retirees. This initiative was made possible in collaboration with the General Retirement and Social Insurance Authority (GRSIA).

Innovative Products and Community Support

QNB also offers a range of insurance products tailored for elderly customers through its international branches. One notable offering is the Al Rafiq Retirement Program from QNB Egypt Life Insurance, which provides a savings and investment package aimed at ensuring financial stability during retirement.

In addition to financial products, QNB has developed partnerships with organizations focused on elderly care. The bank has supported the Center for Empowerment and Elderly Care (Ehsan) since 2015, reinforcing its commitment to social integration and support for this demographic.

Since 2009, QNB has introduced several innovative services, such as equipping ATMs with Braille keyboards and audio guidance systems to assist customers with visual and hearing impairments. These ATMs comprise approximately 5% of the total number of machines, allowing for secure and convenient transactions.

Furthermore, all bank branches feature dedicated entrances for wheelchair access, designated parking spaces for those with special needs, and signage designed to assist visually impaired customers. Emergency protocols and priority queuing systems have also been established to enhance service delivery.

QNB’s ongoing efforts in this area reflect its commitment to the Qatar National Vision 2030, which emphasizes the importance of integrating all community members into societal activities. The bank continues to support various programs, including the “Empowering People with Special Needs Through Small Projects Program,” launched by the Department of the Elderly and People with Special Needs at the Ministry of Social Affairs.

Recently, QNB initiated an early intervention therapeutic program in partnership with the Qatar Autism Society. This program aims to support children with autism spectrum disorder and their families, facilitating their integration and learning from an early age.

Through these concerted efforts, QNB Group is not only enhancing access to banking services but is also fostering a more inclusive society where the elderly and individuals with special needs can thrive as active participants in community development.

Business

New Zealand’s Economic Outlook: Is the Investment Winter Over?

Recent data indicates a potential shift in New Zealand’s economic landscape. The Consumer Price Index (CPI) for the June quarter recorded an unexpected decline to 2.7%. This figure raises the possibility of a rate cut by the Reserve Bank of New Zealand in the upcoming month, leading to speculation about whether the prolonged investment downturn in the country may finally be coming to an end.

In a discussion with Tim Beveridge on the Smart Money podcast, Shane Solly, a director at Harbour Asset Management, provided insights into the implications of this CPI figure. He noted that the lower-than-anticipated inflation rate could create favorable conditions for investors and stimulate economic activity.

Potential Rate Cuts and Market Reactions

The Reserve Bank has maintained a cautious approach in recent months, responding to various economic indicators. If the bank decides to lower interest rates, it could bolster consumer spending and investment, which have been sluggish due to higher borrowing costs. Solly emphasized that a rate cut would likely enhance liquidity in the market, encouraging businesses and consumers to spend more freely.

According to Solly, the recent CPI data suggests that inflationary pressures are easing. This could result in a more favorable environment for investments, particularly in sectors that have struggled during the past year. He mentioned that the market has already begun to react positively to the prospect of lower rates, with increased interest in equities and real estate.

Investor Sentiment and Future Prospects

As New Zealand grapples with potential changes in monetary policy, investor sentiment appears cautiously optimistic. Many are keen to explore opportunities in the market, particularly if the Reserve Bank signals a shift in its approach. Solly remarked that the investment landscape is evolving, and those who adapt quickly could reap substantial rewards.

The discussion also highlighted the importance of understanding global economic influences. With the prospect of a “melt up” in markets worldwide, New Zealand investors must stay vigilant and informed. Solly noted that global trends can have significant local impacts, and being attuned to these changes can help investors make informed decisions.

In conclusion, the recent CPI data offers a glimmer of hope for New Zealand’s economy. With the possibility of a rate cut on the horizon, the investment landscape could shift dramatically. As Shane Solly pointed out, the key for investors will be to navigate these changes wisely and capitalize on emerging opportunities.

This evolving situation will be closely monitored as the Reserve Bank’s decision approaches. Investors and analysts alike are eager to see how New Zealand’s economy will respond to both local and global economic developments in the coming months.

Business

Enhance Sales on Shopify: Strategies Beyond Ad Spend

Many online retailers experience challenges converting website traffic into sales, particularly those using the Shopify platform. According to digital marketing expert Jeanine Pickford, increasing ad spend on platforms like Google or Meta may not be the solution. Instead, retailers should focus on optimizing their sites to improve conversion rates.

When traffic is high but sales remain low, the issue often lies within the website itself rather than the effectiveness of advertising. Spending more on ads without addressing underlying site issues can lead to increased costs with little to no improvement in sales figures.

Key Areas for Improvement

Before considering a larger advertising budget, businesses should explore several strategies that can significantly enhance sales performance.

One effective method is to encourage repeat purchases through targeted email marketing. Engaging past customers with personalized offers and updates can foster loyalty and drive additional sales.

Building trust is equally crucial. Retailers should leverage social proof by showcasing positive customer reviews, testimonials, and case studies. This kind of validation can help potential buyers feel more confident in their purchasing decisions.

Additionally, improving product images and descriptions is essential for showcasing products effectively. High-quality visuals and detailed descriptions can create a more appealing shopping experience, making it easier for customers to understand what they are buying.

Another important factor is the overall site experience. Streamlining the purchasing process to ensure it is easy, seamless, and free of barriers can lead to higher conversion rates.

Taking Action for Growth

For those ready to enhance their Shopify store and achieve real growth, professional assistance is available. Jeanine Pickford and her team at Creative Web Designs offer tailored solutions to help retailers optimize their online presence and reach their sales goals. Interested parties can contact her at [email protected] or call 021 211 2384 for further guidance.

In conclusion, rather than solely increasing ad spend, businesses should evaluate and improve their website functionalities to maximize their sales potential. Taking a holistic approach can lead to more effective results and sustainable growth in the competitive online marketplace.

Business

NPC Faces $5 Million Shortfall, Future of Event in Jeopardy

The future of the National Player Championship (NPC) is uncertain as the organization grapples with a financial shortfall exceeding $5 million. This iconic competition, cherished by players and fans alike, now faces significant challenges as it seeks to address its budgetary issues.

As of October 2023, the NPC has been a mainstay in the competitive gaming landscape, drawing thousands of participants and spectators. However, the current financial predicament raises concerns about the viability of the event moving forward. Stakeholders are urged to consider potential solutions to avert a crisis that could impact the future of this beloved competition.

Many players have expressed their disappointment regarding the NPC’s financial struggles. They emphasize the importance of the event not just for personal achievement but also for community engagement. The NPC has historically provided a platform for skill development and networking opportunities in the gaming industry.

Despite its popularity, the NPC’s revenue streams have not kept pace with operational costs. Sponsorship deals and ticket sales have not generated sufficient income to cover the expenses associated with hosting the event. This gap in funding has prompted urgent discussions among the NPC’s leadership and financial advisors.

Efforts to bridge the shortfall are underway, but the clock is ticking. The NPC must explore new avenues for revenue generation, such as increased sponsorships, merchandise sales, and possibly expanding its digital presence to attract a global audience. A strategic overhaul may be necessary to ensure the event’s sustainability.

The NPC’s leadership is committed to finding a solution. They are engaging with financial experts and stakeholders to devise a comprehensive plan. The aim is to not only address the immediate financial concerns but also to lay the groundwork for the long-term success of the championship.

In light of its current situation, the NPC’s management has scheduled a series of meetings with potential sponsors and partners. They hope to secure commitments that can alleviate the financial burden and restore confidence in the event’s future.

The NPC community remains hopeful that solutions can be found. Players and fans alike are eager to see the championship thrive once again, emphasizing that the NPC is more than just a competition; it is a celebration of skills, community, and passion for gaming.

As the NPC navigates this challenging period, the emphasis will be on transparency and collaboration. Stakeholders are encouraged to participate in discussions that could lead to innovative strategies and partnerships, ultimately ensuring that the NPC continues to be a hallmark event in the gaming calendar.

-

Politics2 weeks ago

Politics2 weeks agoDavid Seymour Proposes Fast-Track Law for New Supermarkets in NZ

-

Entertainment2 weeks ago

Entertainment2 weeks agoGeorge Calombaris Opens Up About Alcohol Struggles After Scandals

-

Top Stories2 weeks ago

Top Stories2 weeks agoTragic Crash Claims Three Lives on Masters Rd Near Waiuku

-

World2 weeks ago

World2 weeks agoDaughter Accused of Murdering Mother in Khandallah Home

-

World2 weeks ago

World2 weeks agoCoalition Leaders Address UN Rapporteur’s Criticism, Clarify Response

-

World2 weeks ago

World2 weeks agoKalyn Ponga Explores Future Options Amid Newcastle Knights Struggles

-

World2 weeks ago

World2 weeks agoDriver High on Magic Mushrooms Crashes with Child in Car

-

Top Stories2 weeks ago

Top Stories2 weeks agoTauranga Airline Suspended After Safety Concerns Arise

-

Health2 weeks ago

Health2 weeks agoWoman’s Missing Engagement Ring Found in Waiuku Mudflats

-

Business2 weeks ago

Business2 weeks agoSouth Waikato Trades Training Centre Faces Closure Proposal

-

World2 weeks ago

World2 weeks agoQueenstown’s The Rees Hotel Fined $22,000 for Illegal Crayfish Sales

-

Top Stories2 weeks ago

Top Stories2 weeks agoBlues Consider Move to Mt Smart in Search of Better Attendance