Business

Turkiye’s Machinery Exports Reach $13.7 Billion in H1 2023

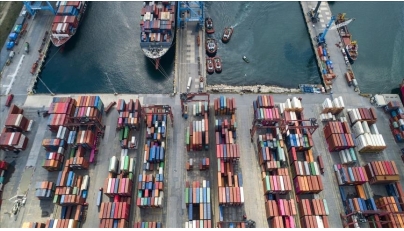

In the first half of 2023, Turkiye’s machinery exports generated $13.7 billion, representing a 0.3 percent increase from the same period in the previous year. This growth highlights the resilience of the machinery sector amid fluctuating global market conditions.

Leading Importers of Turkish Machinery

The Turkish Machinery Exporters’ Association released data showing that Germany was the largest importer of Turkish machinery, with imports valued at $1.5 billion. Following Germany, the United States imported $871 million worth of machinery, while Italy ranked third with imports totaling $593 million. These figures underscore the strong demand for Turkish-made machinery in key international markets.

Overall Export Performance

According to additional data from the Ministry of Trade and the Turkish Exporters Assembly, Turkiye’s total exports for the first half of 2023 reached $131.44 billion. This figure reflects a notable 4.1 percent increase compared to the first half of 2022. The growth in overall exports indicates a positive trend for Turkiye’s economy and its position in global trade.

The machinery sector’s performance is critical for Turkiye, as it plays a significant role in the nation’s economic landscape. As the country continues to enhance its manufacturing capabilities, the focus on maintaining strong relationships with major importing countries will be essential for sustaining growth in the coming quarters.

-

World2 weeks ago

World2 weeks agoPrivate Funeral Held for Dean Field and His Three Children

-

Top Stories2 weeks ago

Top Stories2 weeks agoFuneral Planned for Field Siblings After Tragic House Fire

-

Sports3 months ago

Sports3 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment3 months ago

Entertainment3 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment2 months ago

Entertainment2 months agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports3 months ago

Sports3 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Sports1 month ago

Sports1 month agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

World3 weeks ago

World3 weeks agoInvestigation Underway in Tragic Sanson House Fire Involving Family

-

Politics2 months ago

Politics2 months agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

Top Stories2 weeks ago

Top Stories2 weeks agoShock and Grief Follow Tragic Family Deaths in New Zealand

-

Entertainment3 months ago

Entertainment3 months agoKhloe Kardashian Embraces Innovative Stem Cell Therapy in Mexico

-

World4 months ago

World4 months agoPolice Arrest Multiple Individuals During Funeral for Zain Taikato-Fox