Business

Accountability Questioned as Reserve Bank Faces Economic Criticism

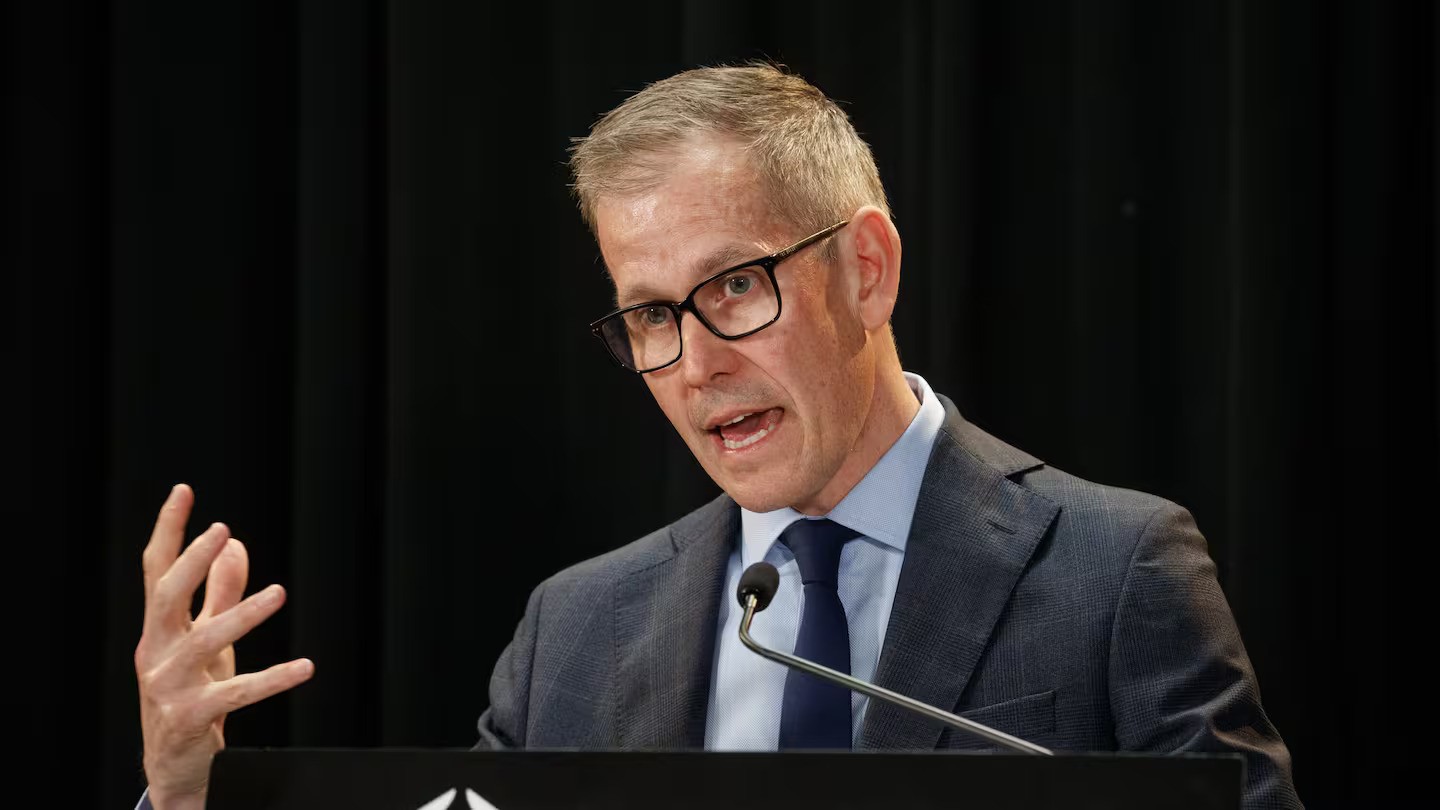

The Reserve Bank of New Zealand is under scrutiny as questions arise about accountability following its recent monetary policy decisions. The bank’s leadership, including former Governor Adrian Orr and now Christian Hawkesby, faces criticism for their handling of the economy after the committee’s decision to maintain the cash rate in July 2023, despite signs of economic contraction.

During the second quarter of 2023, which included April, May, and June, the Reserve Bank projected a contraction of only 0.3%. However, recent data revealed a more significant contraction of 0.9%, raising concerns about the accuracy of the bank’s forecasts. The decision to hold the cash rate steady has led many to question whether the monetary policy committee is adequately addressing New Zealand’s economic challenges.

Hawkesby and his colleagues on the Monetary Policy Committee have come under fire for their lack of action. Critics argue that the decision to refrain from additional stimulus measures contradicts the reality facing many New Zealanders. Economic indicators suggest a tightening environment, and the committee’s failure to respond has left many feeling disillusioned.

The disparity between the predicted contraction and the actual numbers has prompted calls for accountability within the Reserve Bank. While Orr has resigned, and former Deputy Governor Geoff Quigley was dismissed, the broader committee remains intact. Observers question why these members, who are deemed experts, have not been held to similar standards of accountability for their decisions.

As highlighted in a recent poll, a significant number of New Zealanders assign blame to the government for the state of the economy, a sentiment compounded by the Reserve Bank’s perceived failures. The Prime Minister’s recent comments regarding the Reserve Bank’s independence have sparked debate, with critics arguing that independence should not excuse ineffectiveness.

The Reserve Bank’s response to the economic downturn will be critical in the coming months. As the July 2023 decision echoes through the economy, the pressure mounts for the Monetary Policy Committee to demonstrate that they can adapt to changing circumstances and provide effective leadership.

In a climate where results matter, the need for accountability has never been more pronounced. As New Zealanders navigate these challenging economic times, the actions and decisions of the Reserve Bank will be closely scrutinized. The question remains: who will ultimately be held accountable for the failures that have led to this economic situation?

-

Sports2 months ago

Sports2 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment2 months ago

Entertainment2 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment4 weeks ago

Entertainment4 weeks agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports7 days ago

Sports7 days agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Sports2 months ago

Sports2 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Politics1 month ago

Politics1 month agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

Entertainment2 months ago

Entertainment2 months agoKhloe Kardashian Embraces Innovative Stem Cell Therapy in Mexico

-

Sports4 days ago

Sports4 days agoJamie Melham Triumphs Over Husband Ben in Melbourne Cup Victory

-

World3 months ago

World3 months agoPolice Arrest Multiple Individuals During Funeral for Zain Taikato-Fox

-

Sports3 months ago

Sports3 months agoGaël Monfils Set to Defend ASB Classic Title in January 2026

-

Entertainment1 month ago

Entertainment1 month agoTyson Fury’s Daughter Venezuela Gets Engaged at Birthday Bash

-

Sports1 month ago

Sports1 month agoHeather McMahan Steps Down as Ryder Cup Host After Controversy