Business

Home Listings Surge to Decade High as December Sees Record Inventory

The property market in New Zealand has witnessed a significant increase in available homes, with December 2025 recording the highest stock levels for that month in over a decade. A total of 30,390 properties were listed for sale, marking a 3.1 per cent rise compared to December 2024. This surge in listings indicates a notable shift in market dynamics as sellers take advantage of favorable conditions.

According to data from realestate.co.nz, 11 regions reported year-on-year growth in new listings, with Northland leading at an impressive increase of 11.4 per cent, followed closely by Auckland with an 11.0 per cent rise. The overall trend suggests that sellers are increasingly confident as they head into 2026.

Market Trends and Regional Performance

Despite the typical slowdown in real estate activity during the holiday season, December 2025 saw a year-on-year increase of 2.8 per cent in new listings, amounting to 4,900 properties introduced to the market. The Bay of Plenty region stood out with 385 new listings, a remarkable 22.2 per cent increase from the previous year. Other regions such as Wellington and the Central North Island also reported significant growth, with new listings rising by 18.5 per cent and 12.9 per cent respectively.

Vanessa Williams, a spokesperson for realestate.co.nz, noted that the increased activity during what is traditionally a quieter month indicates a shift in seller behavior. “Seeing this level of activity tells us many people were motivated to sell and felt confident enough to list,” Williams stated.

Conversely, some regions experienced declines in new listings. The Marlborough region saw a drop of 25.2 per cent, while Nelson and Bays and Gisborne recorded decreases of 24.8 per cent and 19.2 per cent, respectively. Notably, Waikato reported its lowest December figures ever, with just 355 new listings, a stark contrast to over 1,000 listings in November 2025.

Price Stability Amid Increased Listings

Despite the surge in inventory, the national average asking price for homes remained stable, increasing by 1.7 per cent year-on-year to $860,274. Only three regions recorded double-digit growth in average asking prices: the Bay of Plenty saw a 13.3 per cent increase to $931,602, Central Otago/Lakes District rose by 13.1 per cent to $1,556,852, and Otago increased by 11.7 per cent to $614,849.

In contrast, Gisborne experienced a significant decline in its average asking price, dropping by 29.1 per cent to $532,314. This marked only the third instance this year that the region’s average asking price fell within the $500,000 bracket. The capital city, Wellington, also faced a downturn, with prices dropping 9.1 per cent year-on-year to $797,463, falling below $800,000 for the first time since May 2024.

Williams highlighted the implications of this price drop for potential buyers. “This softening suggests sellers are meeting the market. For buyers who’ve been waiting on the sidelines, this could be the window they’ve been looking for, especially with more stock on offer,” she noted.

As the market heads into 2026, the high inventory levels recorded in December may signal a renewed wave of activity in the real estate sector. Williams commented, “With national prices holding steady and stock at multi-year highs in the final month of the year, we could see renewed activity in early 2026, especially if confidence builds over summer.”

The evolving landscape of the New Zealand property market offers both challenges and opportunities for buyers and sellers alike, setting the stage for an intriguing year ahead.

-

World2 months ago

World2 months agoPrivate Funeral Held for Dean Field and His Three Children

-

Top Stories2 months ago

Top Stories2 months agoFuneral Planned for Field Siblings After Tragic House Fire

-

Sports4 months ago

Sports4 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment4 months ago

Entertainment4 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment3 months ago

Entertainment3 months agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports4 months ago

Sports4 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Sports2 months ago

Sports2 months agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Politics3 months ago

Politics3 months agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

World2 months ago

World2 months agoInvestigation Underway in Tragic Sanson House Fire Involving Family

-

Sports4 weeks ago

Sports4 weeks agoNathan Williamson’s Condition Improves Following Race Fall

-

Entertainment1 month ago

Entertainment1 month agoJacinda Ardern Discusses Popularity Decline on Graham Norton Show

-

World3 weeks ago

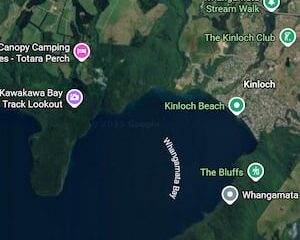

World3 weeks agoInvestigation Launched Following Boat Fire at Lake Taupō