Business

Home Loan Rates in New Zealand: Could They Fall Below 4%?

Home loan interest rates in New Zealand are experiencing a steady decline as the Reserve Bank of New Zealand reduces the official cash rate (OCR) and wholesale market conditions soften. With nearly half of all home loans either floating or due for refixing within the next six months, many borrowers are now questioning whether rates could soon dip below the 4 percent mark.

Several experts are optimistic about the possibility. David Cunningham, CEO of Squirrel, believes it is feasible. He suggests that if the OCR decreases to 2.25 percent, as anticipated, one-year fixed mortgage rates could fall under 4 percent by early 2026. Cunningham emphasizes that the key factors driving this potential decrease will be lower term deposit rates and cheaper bank funding.

Squirrel’s proprietary AI rate-prediction model indicates that rates below 4 percent may be on the horizon. Furthermore, with banks often employing “charm pricing,” such as offering rates at 3.99 percent, it is likely that at least one lender could act early to attract attention.

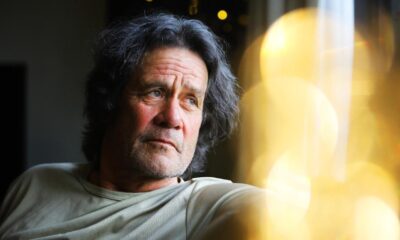

In contrast, Gareth Kiernan, chief forecaster at Infometrics, expresses skepticism. He argues that a rate below 4 percent is unlikely unless the OCR approaches 2 percent. Drawing on historical trends, Kiernan points out that in 2019, mortgage rates only dipped below 4 percent when the OCR remained at 1.75 percent for over two years. He cautions that with current long-term rates firmly anchored at higher levels, the prospect of rates falling significantly is still distant.

While many borrowers are eager for sub-4 percent mortgage rates, economists urge caution. They suggest that the opportunity for ultra-low rates may still be several months away. Kiernan notes that even if the OCR is reduced by another 25 basis points, it may not be sufficient to lower wholesale rates enough to achieve rates below 4 percent.

Kiernan elaborates that long-term rates appear to be more stable at elevated levels, indicating that a drop to an OCR of 2 percent is necessary before sub-4 percent rates can realistically be expected, particularly from the major banks. He points out that smaller lenders might have more flexibility and could offer competitive rates to attract borrowers.

Looking ahead, Kiernan anticipates that home loan rates could begin to rise again around October 2024. As the market continues to evolve, both borrowers and lenders will be watching closely to see how these predictions unfold and what impact they will have on home financing in New Zealand.

-

Sports2 months ago

Sports2 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment1 month ago

Entertainment1 month agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment2 weeks ago

Entertainment2 weeks agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports1 month ago

Sports1 month agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Politics3 weeks ago

Politics3 weeks agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

Entertainment2 months ago

Entertainment2 months agoKhloe Kardashian Embraces Innovative Stem Cell Therapy in Mexico

-

World3 months ago

World3 months agoPolice Arrest Multiple Individuals During Funeral for Zain Taikato-Fox

-

Sports2 months ago

Sports2 months agoGaël Monfils Set to Defend ASB Classic Title in January 2026

-

Entertainment4 weeks ago

Entertainment4 weeks agoTyson Fury’s Daughter Venezuela Gets Engaged at Birthday Bash

-

Sports4 weeks ago

Sports4 weeks agoHeather McMahan Steps Down as Ryder Cup Host After Controversy

-

Entertainment4 weeks ago

Entertainment4 weeks agoTyson Fury’s Daughter Venezuela Gets Engaged at Birthday Bash

-

World4 weeks ago

World4 weeks agoNew Zealand Firefighters Plan Strike on October 17 Over Pay Disputes