Top Stories

Home Loan Rates in New Zealand May Fall Below 4% Soon

Home loan interest rates in New Zealand are trending downward as the Reserve Bank of New Zealand reduces the official cash rate (OCR). This shift, coupled with softening wholesale markets, has prompted speculation about the potential for rates to drop below 4 percent in the near future. Nearly half of all home loans in the country are either floating or set for refix within six months, making this a pressing question for many borrowers.

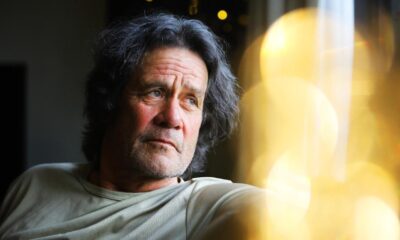

According to David Cunningham, CEO of Squirrel, it is indeed possible for rates to dip below this threshold. He projects that if the OCR falls to 2.25 percent as anticipated, one-year fixed mortgage rates could fall under 4 percent by early 2026. “The key driver will be lower term deposit rates and cheaper bank funding,” Cunningham explained. His company’s AI rate-prediction model supports the idea that sub-4 percent rates are on the horizon, suggesting that at least one lender might adopt “charm pricing,” such as 3.99%, to attract customers.

Despite these optimistic predictions, not all experts share the same view. Gareth Kiernan, chief forecaster at Infometrics, believes that a rate below 4 percent is unlikely unless the OCR approaches 2 percent. He noted that in 2019, rates only fell below 4 percent when the OCR remained at 1.75 percent for an extended period. “With current long-term rates anchored higher, it’s a stretch for now,” Kiernan stated.

While many borrowers are eagerly hoping for sub-4 percent mortgage rates, economists are taking a more cautious stance. They suggest that the window for ultra-low rates may still be several months away. Kiernan pointed out that another reduction of 25 basis points in the OCR may not be sufficient to lower wholesale rates enough for banks to offer rates under 4 percent. He remarked, “Particularly when longer-term rates seem to be more well-anchored at higher levels, I think you’d need an OCR of 2 percent before sub-4 percent becomes a possibility, at least from the big five banks. Smaller lenders may experiment with more competitive rates to attract attention.”

Looking ahead, Kiernan predicts that home loan rates may begin to increase again around October 2024. Borrowers and lenders alike are keenly observing these developments as they navigate a changing economic landscape.

-

Sports2 months ago

Sports2 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment1 month ago

Entertainment1 month agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment2 weeks ago

Entertainment2 weeks agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports1 month ago

Sports1 month agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Politics3 weeks ago

Politics3 weeks agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

Entertainment2 months ago

Entertainment2 months agoKhloe Kardashian Embraces Innovative Stem Cell Therapy in Mexico

-

World3 months ago

World3 months agoPolice Arrest Multiple Individuals During Funeral for Zain Taikato-Fox

-

Sports2 months ago

Sports2 months agoGaël Monfils Set to Defend ASB Classic Title in January 2026

-

Entertainment4 weeks ago

Entertainment4 weeks agoTyson Fury’s Daughter Venezuela Gets Engaged at Birthday Bash

-

Sports4 weeks ago

Sports4 weeks agoHeather McMahan Steps Down as Ryder Cup Host After Controversy

-

Entertainment4 weeks ago

Entertainment4 weeks agoTyson Fury’s Daughter Venezuela Gets Engaged at Birthday Bash

-

World4 weeks ago

World4 weeks agoNew Zealand Firefighters Plan Strike on October 17 Over Pay Disputes