Top Stories

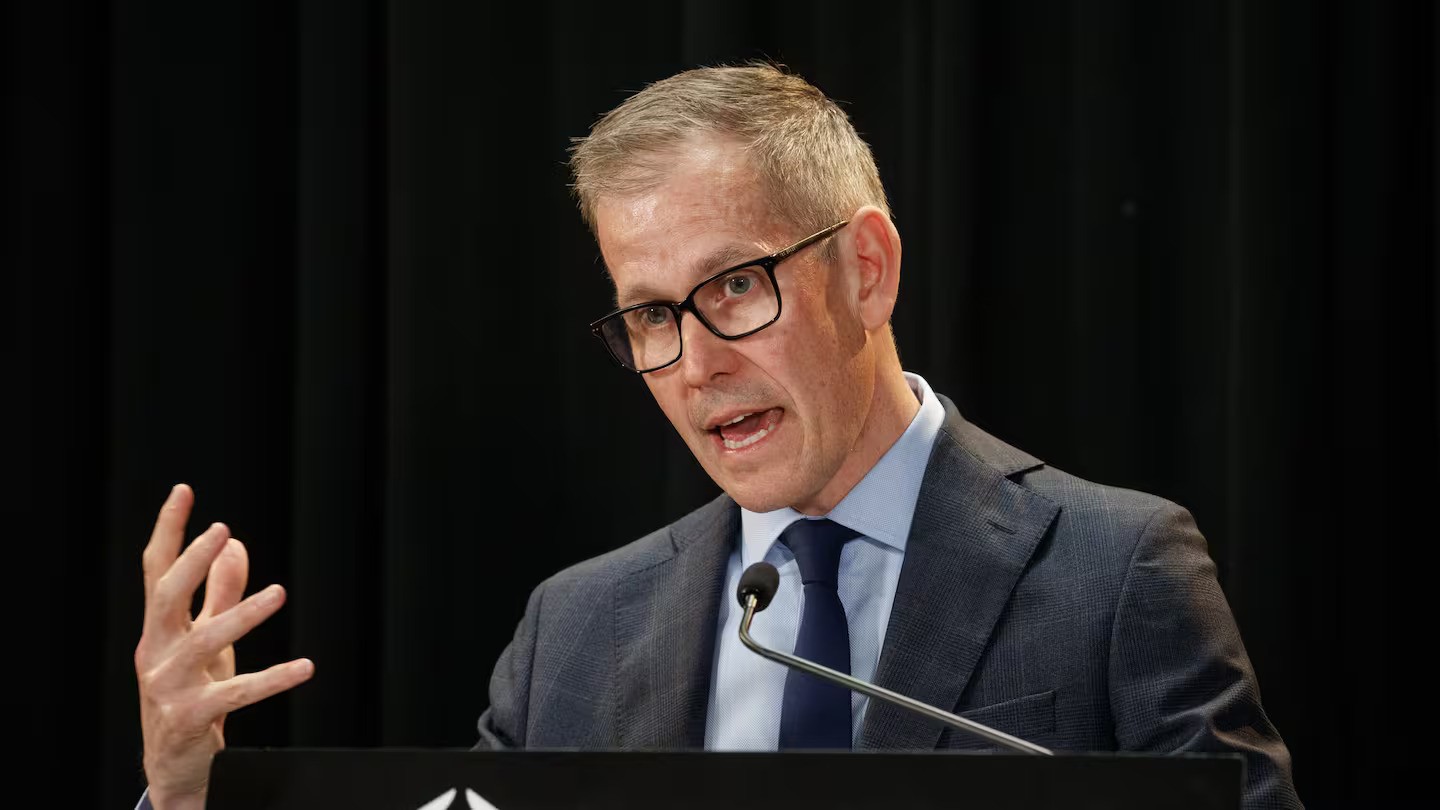

Accountability in Focus as Reserve Bank Faces Economic Criticism

The Reserve Bank of New Zealand is under scrutiny as recent economic forecasts have raised concerns regarding its leadership and decision-making. Following the conclusion of the second quarter (Q2) of 2023, the bank’s monetary policy committee, including Governor Adrian Orr and Deputy Governor Christian Hawkesby, opted to maintain the cash rate without any adjustments despite significant economic challenges.

In July 2023, the committee faced criticism for its decision to hold the cash rate steady, particularly after acknowledging an expected contraction of the economy by 0.3%. Recent data, however, revealed a more severe decline of -0.9%, prompting questions about the committee’s expertise and judgment. Many observers argue that it is easy to place blame solely on the governor when the committee collectively votes on monetary policy actions.

The Reserve Bank’s decision to abstain from further stimulus measures has been met with skepticism. Critics suggest that the committee’s assessment of the economic climate does not align with the realities faced by New Zealanders. Citizens have expressed frustration over the economic conditions, and there is a growing sentiment that the Reserve Bank has fallen short in its responsibilities.

As scrutiny mounts, the question arises: who will be held accountable for these miscalculations? While Orr has stepped down from his position, other members of the Monetary Policy Committee remain in their roles. This raises concerns about the criteria for their appointments and whether their expertise is genuinely aligned with the needs of the economy.

The Prime Minister’s recent comments regarding the independence of the Reserve Bank have further fueled the conversation. While the principle of independence is generally respected, critics argue that it should not shield the bank from accountability, especially when its decisions have such direct impacts on the country’s economy.

Public sentiment reflects a belief that the government and the Reserve Bank share responsibility for the economic challenges currently facing New Zealand. Polls indicate that a significant number of citizens attribute blame to the government for the state of the economy, underscoring the interconnectedness of political and monetary policy decisions.

Moving forward, the Reserve Bank will need to address these criticisms and demonstrate its commitment to effective governance. As economic indicators continue to fluctuate, the expectation for accountability and transparency within the bank remains paramount. The future direction of monetary policy will be closely monitored by both citizens and policymakers alike, as the repercussions of current decisions will likely resonate for years to come.

-

Sports2 months ago

Sports2 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment2 months ago

Entertainment2 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment4 weeks ago

Entertainment4 weeks agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports1 week ago

Sports1 week agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Sports2 months ago

Sports2 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Politics1 month ago

Politics1 month agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

Entertainment2 months ago

Entertainment2 months agoKhloe Kardashian Embraces Innovative Stem Cell Therapy in Mexico

-

Sports5 days ago

Sports5 days agoJamie Melham Triumphs Over Husband Ben in Melbourne Cup Victory

-

World3 months ago

World3 months agoPolice Arrest Multiple Individuals During Funeral for Zain Taikato-Fox

-

Sports3 months ago

Sports3 months agoGaël Monfils Set to Defend ASB Classic Title in January 2026

-

Entertainment1 month ago

Entertainment1 month agoTyson Fury’s Daughter Venezuela Gets Engaged at Birthday Bash

-

Sports1 month ago

Sports1 month agoHeather McMahan Steps Down as Ryder Cup Host After Controversy