Business

Qatar’s Commercial Banks Assets Surge 5.8% to QR2.15 Trillion

According to data released by the Qatar Central Bank (QCB), the total assets of commercial banks operating in Qatar rose by 5.8 percent to reach QR2.15 trillion in November 2025. This growth highlights the sector’s robust performance, driven by strong liquidity, increased lending activities, and ongoing investments.

The QCB shared its findings on its X platform, indicating that key banking metrics experienced significant year-on-year improvements. The increase in total assets underscores the resilience of Qatar’s banking sector, which plays a vital role in supporting the country’s economic diversification goals outlined in National Vision 2030.

Key Indicators of Growth

In addition to asset growth, domestic deposits surged by 2.6 percent, amounting to QR865.9 billion in November 2025. Similarly, domestic credit expanded by 4.8 percent year-on-year, reaching QR1.36 trillion. These figures reflect a solid banking environment that continues to foster economic stability.

The total broad money supply (M2) also saw an increase of 1.2 percent, climbing to QR744.4 billion in November. This growth in money supply can facilitate further lending and investment across various sectors.

Technological Advancements and Strategic Initiatives

The QCB’s vision for financial technology focuses on enhancing the competitiveness of Qatar’s financial services sector. This includes developing pioneering infrastructure and solutions that enhance customer experience. Significant progress has been made in implementing objectives from the Third Financial Sector Strategy and the QCB’s 2024-2030 Strategy, along with the FinTech Strategy and the Environmental, Social, and Governance (ESG) Strategy.

In the past year, several initiatives have been launched, including new regulations for establishing and operating real estate development escrow accounts, guidelines for data processing and protection, and a sustainable finance framework. Additionally, the QCB issued a circular focused on financial services for customers with disabilities and the elderly, demonstrating a commitment to inclusivity.

To support emerging national companies in financial technology, the QCB has continued to grant licenses to fintech firms, reinforcing the development of an advanced digital banking system. These efforts are expected to enhance the overall efficiency and security of financial transactions within Qatar.

As the banking sector continues to evolve, the QCB’s initiatives and the impressive growth in assets indicate a strong foundation for future economic development in Qatar.

-

World2 months ago

World2 months agoPrivate Funeral Held for Dean Field and His Three Children

-

Top Stories2 months ago

Top Stories2 months agoFuneral Planned for Field Siblings After Tragic House Fire

-

Sports4 months ago

Sports4 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment4 months ago

Entertainment4 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment3 months ago

Entertainment3 months agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports4 months ago

Sports4 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Sports2 months ago

Sports2 months agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Politics3 months ago

Politics3 months agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

World2 months ago

World2 months agoInvestigation Underway in Tragic Sanson House Fire Involving Family

-

Sports4 weeks ago

Sports4 weeks agoNathan Williamson’s Condition Improves Following Race Fall

-

Entertainment1 month ago

Entertainment1 month agoJacinda Ardern Discusses Popularity Decline on Graham Norton Show

-

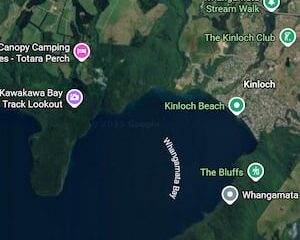

World3 weeks ago

World3 weeks agoInvestigation Launched Following Boat Fire at Lake Taupō