Business

Qatar’s Commercial Banks See 5.8% Asset Growth to QR2.15 Trillion

DOHA, QATAR: Qatar’s commercial banks have demonstrated significant growth, with total assets rising by 5.8 percent to reach QR2.15 trillion as of November 2025. This information comes from official data released by the Qatar Central Bank (QCB).

The QCB reported that the banking sector experienced strong performance due to robust liquidity positions, increased lending activity, and ongoing investments. The findings were published in the November 2025 Monthly Monetary Bulletin, highlighting year-on-year asset expansion.

Key Indicators Reflect Sector Resilience

The rise in assets underscores the resilience of Qatar’s banking sector and its vital role in advancing the country’s economic diversification goals under the National Vision 2030. In addition to asset growth, total domestic deposits surged by 2.6 percent year-on-year, reaching QR865.9 billion. Domestic credit also experienced a notable increase, soaring 4.8 percent to QR1.36 trillion during the same period.

Furthermore, the total broad money supply (M2) increased by 1.2 percent, amounting to QR744.4 billion in November 2025 compared to the previous year. These indicators reflect not only the banks’ stability but also their critical contribution to the national economy.

Strategic Initiatives and Future Outlook

The QCB has been actively working on enhancing the competitiveness of Qatar’s financial technology and services sector. This includes implementing strategic objectives outlined in the Third Financial Sector Strategy and the FinTech Strategy, aimed at fostering innovation and improving customer experiences.

Significant progress has been made in various initiatives over the past year. These include the establishment of regulations for real estate development escrow accounts and guidelines for data processing and protection. Additionally, the QCB issued a sustainable finance framework and a circular addressing financial services for customers with disabilities and the elderly.

The QCB remains committed to supporting emerging national companies in the fintech sector. By granting licenses to financial technology firms, the bank is contributing to the development of an advanced digital financial and banking system in Qatar.

With these developments, Qatar’s banking sector is poised for continued growth, reinforcing its role as a cornerstone of the nation’s economic landscape and its vision for a diversified future.

-

World2 months ago

World2 months agoPrivate Funeral Held for Dean Field and His Three Children

-

Top Stories2 months ago

Top Stories2 months agoFuneral Planned for Field Siblings After Tragic House Fire

-

Sports4 months ago

Sports4 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment4 months ago

Entertainment4 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment3 months ago

Entertainment3 months agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports4 months ago

Sports4 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Sports2 months ago

Sports2 months agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Politics3 months ago

Politics3 months agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

World2 months ago

World2 months agoInvestigation Underway in Tragic Sanson House Fire Involving Family

-

Sports4 weeks ago

Sports4 weeks agoNathan Williamson’s Condition Improves Following Race Fall

-

Entertainment1 month ago

Entertainment1 month agoJacinda Ardern Discusses Popularity Decline on Graham Norton Show

-

World3 weeks ago

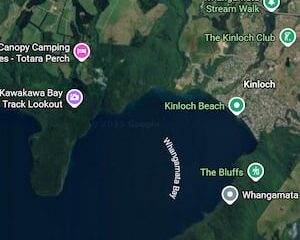

World3 weeks agoInvestigation Launched Following Boat Fire at Lake Taupō