Business

Taiwan’s Garbage Trucks Play Classical Tunes to Signal Trash Time

Taiwan has developed a unique way to manage waste collection that combines practicality with a cultural touch. Garbage trucks equipped with loudspeakers play classical music, signaling residents to take out their rubbish. This initiative has been part of the island’s waste management system for decades, ensuring that households are alerted to dispose of their waste at designated times.

The sound of familiar melodies such as Beethoven’s Fur Elise or Tekla Badarzewska-Baranowska’s Maiden’s Prayer fills the streets of Taipei as the bright yellow trucks make their rounds. Many residents have come to associate these tunes with the arrival of the waste collection service. “When we hear this music, we know it’s time to take out the trash. It’s very convenient,” shared 78-year-old Lee Shu Ning, who was waiting outside her apartment building in the capital.

As the trucks approach, residents emerge from their homes, bags of pre-sorted rubbish in hand. The system encourages proper waste segregation, as different types of waste are collected by separate vehicles. General refuse is tossed into the compaction truck, while food waste and recyclables are placed in designated bins carried by another truck. This organized method not only streamlines the collection process but also promotes environmental responsibility among the community.

The practice has garnered attention for its efficiency and the way it integrates into daily life in Taiwan. Residents have adapted to this auditory cue, making the task of disposing of waste a routine part of their day. For many, the music has become a nostalgic reminder of their childhood and a symbol of community engagement.

In addition to its practical benefits, the use of classical music in waste collection reflects Taiwan’s cultural appreciation for the arts. It fosters a sense of community as neighbors come together, often exchanging greetings while they wait for the trucks to arrive. This initiative highlights how a simple solution can enhance civic life and promote environmental awareness.

As Taiwan continues to innovate in waste management, the classical music trucks serve as a reminder of the importance of blending functionality with cultural values. This unique approach has proven effective, encouraging responsible waste disposal while offering a moment of connection among residents.

-

World2 months ago

World2 months agoPrivate Funeral Held for Dean Field and His Three Children

-

Top Stories2 months ago

Top Stories2 months agoFuneral Planned for Field Siblings After Tragic House Fire

-

Sports4 months ago

Sports4 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment4 months ago

Entertainment4 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment3 months ago

Entertainment3 months agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports4 months ago

Sports4 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Sports2 months ago

Sports2 months agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Politics3 months ago

Politics3 months agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

World2 months ago

World2 months agoInvestigation Underway in Tragic Sanson House Fire Involving Family

-

Sports4 weeks ago

Sports4 weeks agoNathan Williamson’s Condition Improves Following Race Fall

-

Entertainment1 month ago

Entertainment1 month agoJacinda Ardern Discusses Popularity Decline on Graham Norton Show

-

World3 weeks ago

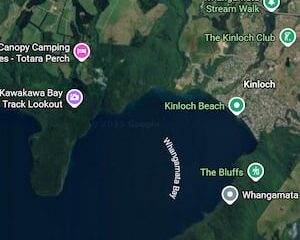

World3 weeks agoInvestigation Launched Following Boat Fire at Lake Taupō