Business

European Stocks Hold Steady Near Record Highs as Year-End Approaches

European stocks maintained stability on December 5, 2025, with little change following the record levels achieved in the previous trading session. Investors exhibited caution as the year-end approaches, leading to a mixed performance across major indices.

Stoxx 600 Index Nears All-Time Highs

The pan-European Stoxx 600 index edged up by 0.08 percent, reaching 589.69 points by 08:14 GMT. This marks a continued proximity to its historic highs, highlighting a strong momentum as 2025 draws to a close.

This year has been marked by significant gains on a monthly, quarterly, and annual basis for the index, with contributions from robust performance across various sectors. As investors assess their positions ahead of the new year, the stability in stock prices reflects a broader market confidence.

Sector Performance Highlights

In terms of sector performance, basic resources companies led the gains, rising by 1.04 percent. This increase coincided with a stabilization in silver and gold prices, which had previously experienced a sharp decline from record levels. The banking sector also experienced a positive shift, climbing by 0.7 percent, indicating resilience in financial stocks.

Conversely, the healthcare sector and consumer-related companies faced challenges, with declines of 0.1 percent and 0.2 percent, respectively. The overall mixed performance among sectors suggests that while some areas are thriving, others are under pressure as the market prepares for the upcoming year.

Major European indices displayed limited movements on this day. The UK’s FTSE index saw a slight increase of 0.1 percent, while stocks in France experienced a marginal decline of approximately 0.1 percent. This indicates a cautious approach among investors as they navigate the current market landscape.

As the market continues to stabilize near record highs, stakeholders will be keenly observing the developments in both global and domestic factors that could influence stock performance in the months to come. The current trends suggest a resilient market, albeit with varying dynamics across different sectors.

-

World1 month ago

World1 month agoPrivate Funeral Held for Dean Field and His Three Children

-

Top Stories1 month ago

Top Stories1 month agoFuneral Planned for Field Siblings After Tragic House Fire

-

Sports4 months ago

Sports4 months agoNetball New Zealand Stands Down Dame Noeline Taurua for Series

-

Entertainment4 months ago

Entertainment4 months agoTributes Pour In for Lachlan Rofe, Reality Star, Dead at 47

-

Entertainment3 months ago

Entertainment3 months agoNew ‘Maverick’ Chaser Joins Beat the Chasers Season Finale

-

Sports4 months ago

Sports4 months agoSilver Ferns Legend Laura Langman Criticizes Team’s Attitude

-

Sports2 months ago

Sports2 months agoEli Katoa Rushed to Hospital After Sideline Incident During Match

-

Politics3 months ago

Politics3 months agoNetball NZ Calls for Respect Amid Dame Taurua’s Standoff

-

World1 month ago

World1 month agoInvestigation Underway in Tragic Sanson House Fire Involving Family

-

Sports2 weeks ago

Sports2 weeks agoNathan Williamson’s Condition Improves Following Race Fall

-

Entertainment3 weeks ago

Entertainment3 weeks agoJacinda Ardern Discusses Popularity Decline on Graham Norton Show

-

World1 week ago

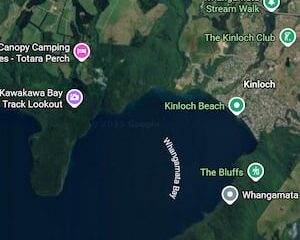

World1 week agoInvestigation Launched Following Boat Fire at Lake Taupō